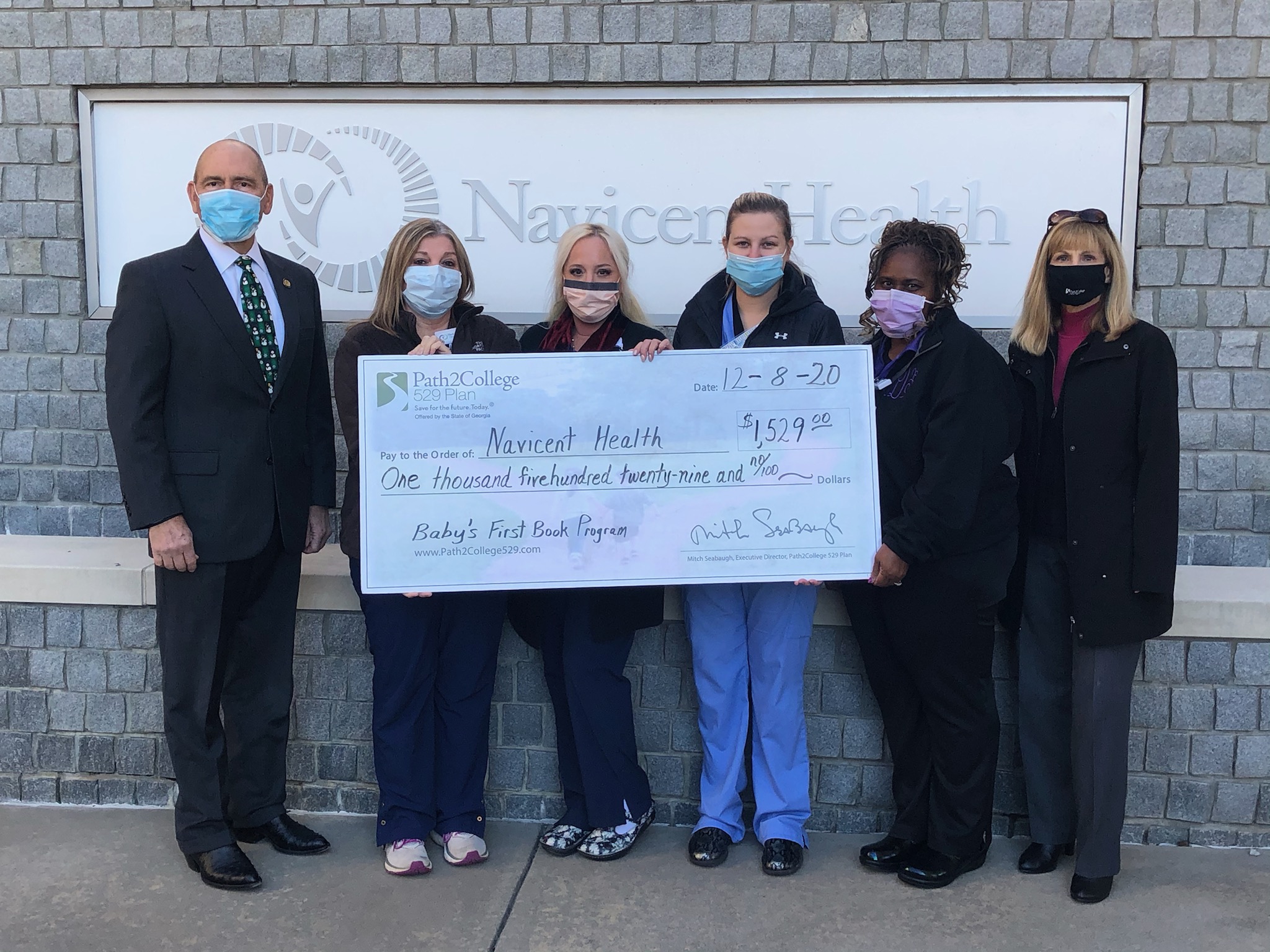

Path2College 529 Plan Celebrates Season of Giving with $1,529 Donation to Navicent Health’s Baby’s First Book Program

The state of Georgia’s college savings plan, the Path2College 529 Plan, is celebrating the season of giving with a $1,529 donation to Navicent Health’s baby’s first book program in the hospital’s birthing center. Through Navicent Health’s baby’s first book program, each newborn delivered at Navicent Health is provided a book prior to discharge. The program encourages new parents to begin reading to their infants from the beginning.

“It is never too early to begin reading to your little one. Reading to an infant promotes bonding, stimulates baby’s mind through the rhythms and patterns of your voice, provides visual stimulation, and has long term benefits such as expanded vocabularies and a desire to read on their own. We are grateful for Path2College’s continued support of this program to encourage and promote the education of Georgia children,” said Missi Upshaw. Director of Pediatrics and Women’s Services for Navicent Health.

Path2College has partnered with Navicent Health since 2016 on an annual “Tax Day Baby” celebration, where the first baby born on tax day receives a college savings contribution.

“This donation is a way for us to recognize our valued partners and also help Georgia children,” said Lynne Riley, President of the Georgia Student Finance Commission, which partners with the Office of the State Treasurer to administer the Path2College 529 Plan for the state of Georgia.

Riley said she hopes to inspire families across the state to consider a lasting investment as they celebrate this season of giving.

“Friends and family can help children in their lives by giving to a child’s college savings account. A tangible gift will bring immediate joy to a child this holiday season, AND giving the gift of education will have a tremendously positive impact on their future,” said Riley.

Anyone can make a contribution to a Path2College account for as little as $25. To give, simply click on the “Gift” section at www.Path2College529.com and download the certificate to show that a contribution has been made.

For those wishing to encourage their friends and family to give, the Path2College 529 Plan provides the tools to create a custom invitation for giving. The e-mail contains a link that, when clicked on, goes to a secure web page to make an electronic contribution from a checking or savings account.

For more information about the Path2College 529 Plan or to open a college savings account, please visit www.Path2College529.com or call (877) 424-4377.

To learn more about the Path2College 529 Plan, its investment objectives, tax benefits, risks, and costs please see the Plan Description at path2college529.com. Read it carefully. Investments in the Plan are neither insured nor guaranteed and there is the risk of investment loss. Check with your home state to learn if it offers tax or other benefits such as financial aid, scholarship funds or protection from creditors only available for investing in its own 529 plan. Consult your legal or tax professional for tax advice. If the funds aren't used for qualified higher education expenses, a 10% penalty tax on earnings (as well as federal and state income taxes) may apply.

TIAA-CREF Individual & Institutional Services, LLC, Member FINRA, distributor and underwriter for the Path2College 529 Plan.