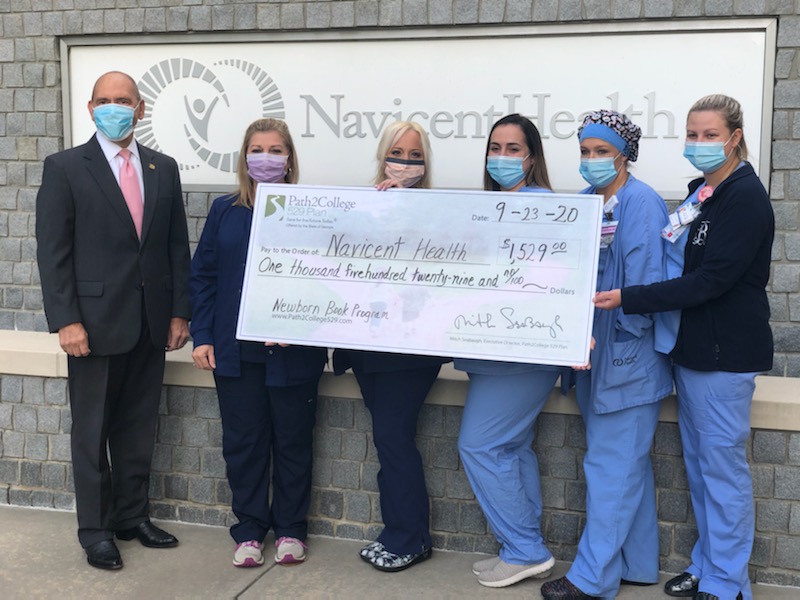

Navicent Health Receives $1,529 for its Babys First Book Program to Encourage Education During College Savings Month and Year round

To celebrate College Savings Month and to help raise awareness about the importance of saving for college and early education, the state of Georgia's Path2College 529 Plan provided Atrium Health Navicent with $1,529, intended for its baby's first book program in the hospital's birthing center.

"Atrium Health Navicent has partnered with us for years to recognize the first Tax Day Baby born at their hospital, and we wanted to give something back to help them provide resources for new parents," said Lynne Riley, president of the Georgia Student Finance Commission which partners with the Office of the State Treasurer to administer the Path2College 529 Plan for the state of Georgia. "Both reading and financial planning are vital to the educational success of children, so it's the perfect way for us both to help Georgia children achieve their goals."

Through Atrium Health Navicent's baby's first book program, each newborn delivered at Atrium Health Navicent will be provided a book prior to discharge. The program encourages new parents to begin reading to their infants from the beginning.

"It is never too early to begin reading to your little one. Reading to an infant promotes bonding, stimulates baby's mind through the rhythms and patterns of your voice, provides visual stimulation, and has long term benefits such as expanded vocabularies and a desire to read on their own. We're pleased to partner with Path2College to encourage and promote the education of Georgia children," said Missi Upshaw. Director of Pediatrics and Women's Services for Atrium Health Navicent.

For more information about the Path2College 529 Plan or to open a college savings account, please visit www.Path2College529.com or call (877) 424-4377.

To learn more about the Path2College 529 Plan, its investment objectives, tax benefits, risks, and costs please see the Disclosure Booklet at path2college529.com. Read it carefully. Investments in the Plan are neither insured nor guaranteed and there is the risk of investment loss. Check with your home state to learn if it offers tax or other benefits such as financial aid, scholarship funds or protection from creditors only available for investing in its own 529 plan. Consult your legal or tax professional for tax advice. If the funds aren't used for qualified higher education expenses, a 10% penalty tax on earnings (as well as federal and state income taxes) may apply.

TIAA-CREF Individual & Institutional Services, LLC, Member FINRA, distributor and underwriter for the Path2College 529 Plan.